Now that you have a budget, we can look at the one big expense that most people find daunting to understand, interest on debt, and there are lot of types of debt. Let’s once again use our keep it simple model. Remember, do not discount the value of keeping it simple, we are not “glossing” over important facts here, we are doing the hard work it takes to build a foundation for our finances and choosing not to spend our time on what doesn’t pose a great concern.

We can always look at our monthly expenses and make plans to cut our food budget or even physically move to adjust our rent costs, but what about that debt. Many people will have mortgages, car notes, perhaps a loan on their home, as well as credit card payments. A key point to realize is that some debt is not bad and is common. Most people have a mortgage payment that they intend to pay for an extended period. In addition, few people pay cash for new cars and most people often have a three or more-year payment plan. Many people live in a constant state of having auto loans. In addition, many people carry credit card debt, which will be a focus of ours because credit card debt traditionally charges very high interest rates. The main point to realize here is that debt is common and not always bad, it gets bad when a large portion of your income is solely paying interest payments on debt or even worse, if your debt is consistently increasing over time. If that is the case, we will work towards and always find a solution. Do not underestimate how hard this will be, but there always is a solution if you are willing to change your lifestyle. In the most dramatic cases if you feel lost always keep in mind, bankruptcy is an option and is a protection that is there to help you if you get too stuck in a debt trap.

First, some general concepts regarding debt.

Concept 1: Most people carry debt in one form or another, mortgage debt is very common.

Concept 2: Debt usually has two features we would like to focus on. The first item is the interest you pay on the debt you owe. The second item is the amount of principal you are paying down on the total debt you have. In paying down principal you are lowering your debt and thus lowering future interest payments. If you are only paying interest your total debt is not changing. If you are paying less than the interest owed, your total debt is increasing.

Concept 3: In making the decision to start eliminating debt, you should initially focus on the debt you owe that charges you the highest interest rate. This should make sense, why not focus on what is creating your largest monthly expenses first?

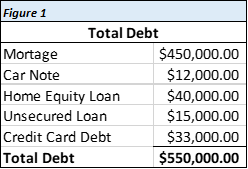

With these three concepts and a simple chart we can get a grasp of our debt situation and perhaps look at our debt and plan to reduce it in the most logical way. This is by eliminating our highest interest-charging debt first. On the other hand, maybe we do not even need to make any changes. Figure 1 below shows a simple chart that sums up a potential individual’s total debt outstanding. This is composed of different forms of debt owed. At this point we are not looking at monthly flow payments of interest on debt, all we want to see is the total sum of all loan amounts that are currently being borrowed.

Above, we can see this individual has a few different forms of debt. The largest amount of debt is the mortgage they owe on a home they purchased. In addition, that person owes $12,000 on a car that they purchased that they intend to pay back overtime. Perhaps that person made home renovations and took out a Home Equity Loan on their home to afford those renovations. In addition, it looks like they took an additional loan without any collateral listed as “Unsecured Debt.” This loan is termed “unsecure” because unlike our Home Equity Loan there is no home or other asset used as collateral. Lastly, we have our credit card debt, again the focus of this article. It is important to reiterate that this is the total amount of all the loans or all the debt the person owes, at this point we are not discussing monthly payments on that debt.

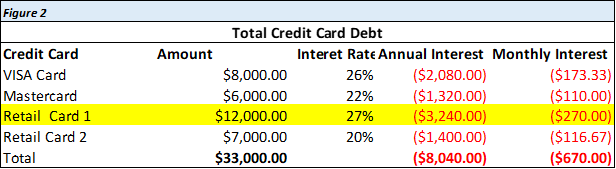

Moving on to Figure 2 we are going to look at the various monthly payments that we then summarize and total into our previous budget as interest expense.

NOTE: For payments we owe monthly or “costs,” accountants will often use negative numbers or numbers that are in parenthesis, this signifies money that we owe, not money we earn that comes into our accounts.

Keep in mind that in Figure 1above we have credit card debt. We could have calculated this debt as principal and interest payments, or just interest payments. Figure 2 assumes we are not paying down principal but just paying the minimum interest owed each year. In this case, if we do not add any credit card debt and just pay interest, our total debt principal remains unchanged. Looking at the bottom right number of Figure 2 shows that we are paying $670 each month just to pay interest on our credit cards. When you start to look at this you realize how much you can save on credit card interest by eliminating your debt or paying your full balance each month.

It is logical to notice that regardless of the amount of debt on each card you would of course want to first eliminate the credit card with the highest interest rate by paying down that total “Amount” column which is your total outstanding balance. If you had extra income after expenses, you would start by paying down debt on “Retail Card 1,” which is highlighted.

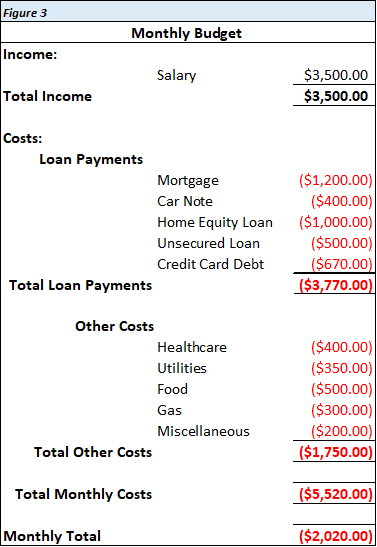

Finally, in Figure 3 we can see how our interest payments each month in Figure 2 would fit into the “Monthly Budget” we created from the previous article “Starting a Budget.” Here I added a row titled “Loan Payments.” For each payment I put down some hypothetical amounts, but you can see that our credit card payments all add up to our total monthly payments on credit card debt. Keep in mind these are only interest costs each month. Our total outstanding credit card debt remains unchanged.

As you can see in Figure 3,we have a person that is clearly not able to meet their total monthly costs of $5,520 each month so to make up the difference that person needs to borrow an additional amount of $2,020 each month.

CONCEPT: There is a simple concept going on here that applies to individuals, companies and governments. If you are earning less income than you are paying for expenses, you need to do one of two things. You must use stockpiled savings to make up the shortfall between what you earn and what you spend, or you need to obtain additional loans to finance your lifestyle.

This is a dangerous trend to continue as this person is stuck in a debt trap, each month they are borrowing more to make up what they cannot afford with their income. If you do not have ample savings to use for this shortfall, each month you are digging yourself further into debt.

Now we have addressed the scariest part of a budget that most people avoid. If you have been able to get through this step and get a final number, with some estimates for Figure 3, then you are well on your way to understanding your financial situation. You have faced the biggest financial hurdle that most people do not want to think about. It is important here to realize that you have made big progress at this point. We have a starting point for planning our future finances. Our monthly budget is the foundation.