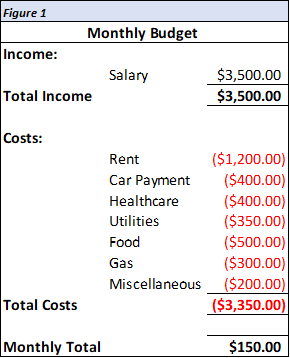

This will be our first article that you can take concrete action on to change your financial situation without earning more income. There may be some painful changes to your lifestyle, but they can be done. If you desire mor financial freedom these steps start the process of getting you there. Not worrying about meeting your expenses is one of the best feeling achievable. Based on what we have learned so far regarding budgeting as well as what we need to build up for a safety cushion now is a good time to take a little bit more of a look at our expenses. Remember Figure 1 shown again below from our budget article:

This was our first crack at trying to see whether we were saving money or spending more money than we received in income. Since we are now at a point where we working towards putting together a “Rainy Day Fund” we can start to work on how we want to do that. We have two ways to build our savings:

- Earn additional income

- Spend less on expense

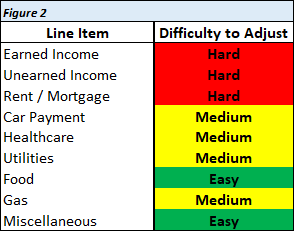

Pretty obvious right, however, this article still gets us through some basics as far as ideas on how to start boosting our savings each month or at least cutting some costs. Let’s review what we have in Figure 2 below. Our first step is to rank how difficult it is to change or adjust each item in our budget, from there we will go a little bit more in depth on each “Line Item.”

Line Item: Just like it sounds a line item is just an accounting or finance term to refer to a specific line or group of lines in a financial statement. This can apply to an individual or a company. Remember, our budget is a simple financial statement.

NOTE: At this point you may realize that our taxes are missing. To simplify this step we have left these out. We are assuming in our budget that our income is what we receive each month after withholding taxes from our employer. Put simply, our income for this article has our taxes already removed and is the cash, check or direct deposit we receive. There are methods to save taxes, that will be discussed in future articles.

Income – Earned income is your salary, bonuses, wages, commissions and tips.

The only way to change your earned income is to get a promotion at work or to search for a new job. Obviously, we need to realize that this is a difficult item to change. The specifics of getting a promotion or a new job are going to be specific to your circumstance. That is outside the scope of this article. While changing your job can have the most impact on your monthly savings, that is something specific that we will save for later. If you do have a chance to get a higher paying job you can significantly improve (save), more on a monthly basis.

Income – Unearned Income is going to be income in the form of interest and capital gains on your investments as well as any government assistance or transfer payments.

Since we have not gone into investment at this point and we really do not want to delve into how to get additional government assistance we will stick with money earned based on your job.

Costs – Rent: Now we move down to our costs and we begin with our mortgage payment or our rent depending on our situation. Again, this is usually a cost that does not change significantly in the short-term. This is because we usually have a lease or a mortgage and short of physically moving this cost cannot be cut easily. Remember though, this is most likely your largest expense, if costs need to be cut you may have to be willing to move to a new location. Perhaps this is a geographic area that is cheaper or a smaller home. Do not rule out ever changing your monthly rent or mortgage because of the difficulty. Also, from our earlier article on budgeting, recall that the rule of thumb is something around 30% of your income should go to your rent or mortgage. This is a rough estimate and has been significantly increasing, especially in the United States over the past few decades.

At this point we are also going to consider home insurance. If you do not have it get it and if you do have it consider shopping around for a better deal and coverage, at minimum, review your current home insurance or rental insurance and your other options. Home insurance costs can be coupled with rent here.

Costs – Car Payment: The cost of transportation is large for most people. In this case we have our car payment if you own one. This is a source for significant cost savings if you are willing to compromise. Being from the United States I realize that at least here we love our cars. Whether or not to lease your car or purchase is out of the scope of this article. The point here is that if we need to trim costs, a car payment is something to consider. Many people spend significantly on their cars and perhaps downsizing is an economical way to help your budget.

At this point we will also add in car insurance to our car payment. Car insurance is a significant cost. Consider reviewing your current policy as well as coverage and decide if you can afford to make or should make any adjustments.

Costs – Healthcare: A hot button everywhere these days. When I say healthcare what I mean is your monthly health care premiums. We do have copayments as well as medical needs that are not covered here. These should also be included in your healthcare costs if you can reasonably estimate them and they are reoccurring. However, from the article on a “Rainy Day Fund,” the goal is to build savings to cover unanticipated costs that are not reoccurring. Our budget is for costs we can reasonably predict. Cutting healthcare costs really involves deciding whether you want to drop to a lower coverage plan. We have a whole article on this that we will go into in the future. This is dependent on your employer and what country you live in. We can cut our premiums here but since health is so important this is relatively hard to change.

Costs – Utilities: Utilities are another cost that are relatively constant over time. It is difficult to cut these bills. The most common utilities are listed below. As consumers these may be bundled differently but in general there are three categories. We decided to list these as “Medium” because they are usually constant and seasonally based but can be trimmed.

Heating/Gas/Electric: These are the items that usually leave you stuck with one service provider for each or all three. The easiest way to cut costs here is to reduce your use of air conditioning over the hot months, use devices that consume less electricity, or better insulate and mange your home to reduce heat loss. One can go into detail on each of these, but these are the basics.

Water/Sewage: This is usually a small cost that will not be tampered with, of course saving water is an option that we can go into detail on in the future but for most people this is not a major monthly cost.

Trash Removal: Most likely we will not be changing these, however, it does pay to look at whether you can switch providers here to save costs.

Costs – Food: When I see most people’s budgets, if they haven’t already trimmed their food bill this is a great and very impactful way to cut costs. In short, buy more groceries, plan your meals and stop eating out frequently. The first step here is to look at how much you are spending each month and hit the grocery store more and eat out less. You will be surprised how much money you are spending eating out. Even cutting out that morning coffee and brewing your own can save hundreds each month. I often hear of people complaining about their expenses when they are spending $5 daily on a coffee, that they could brew at home for less than $.50. Of course, we need something small here and there that makes us happy but focus on cutting things that aren’t that important to you.

Costs – Gas/Metro/Bus Fare: Assuming you own a car, you are paying for gas or diesel. If you don’t you are probably paying for public transportation in some form. The best way to cut this bill without changing your commute is to carpool or purchase a car that uses less gas.

Costs – Miscellaneous: This is our grab bag of costs that do not really fit into any other category. I will list a few common items for your review so you can see what you would be able to live without relatively easily. Add your additional other costs here.

Monthly Subscriptions: Here is where we need to review our newspaper and magazine costs. Perhaps we also have Netflix, Hulu, Amazon Prime and Disney Plus. Could we cut any of these or maybe get rid of our cable TV?

Memberships: Do we belong to a gym we do not frequently attend? Are we getting a monthly order for perhaps pet toys, clothing or another item that we do not particularly need? Dollar shave club? Maybe it is time to lose the country club or golf course membership.

Charity: This is tough but worth a look. Charity is an important thing for most people to support in one way or another. However, if you are in debt and paying a lot of interest each month you may be able to give more in the future if you can get rid of those large interest payments.

Vacations: Not a lot needs to be said here. Look at what you are spending each year on trips. Maybe you would be better off getting an Air B&B for your next trip or driving within your own country as opposed to flying overseas. You could always visit family or friends in different states as well.

This article should have given you something if not a lot to think about. This is our first real article of action. Prior to this we have really worked to build a basis of understanding of our current financial situation as well as some concepts. If you got through this article you can now try putting some of the above cost-cutting techniques into play. Start small and make some minor adjustments, your standard of living does not need to be damaged significantly to save some each month. To keep your spirits up keep track of what you save each month.

CONCEPT: Remember the saying “A penny saved is a penny earned,” well its not true. A penny that you saved is more than a penny earned because a you have already paid income tax on dollars that you are saving. A penny earned is a penny that you still must pay income tax on. Good luck!