Now we move to another scary topic, the retirement plan. The rules here apply strictly to people within the United States. The concept is powerful but varies across different countries. Just the topic of this is enough to shut people down and make them want to stop reading. However let’s do this in a way that tries to make things less difficult than they need to be.

In this article we will review the main concepts of retirement plans including:

- Basic types of retirement plans

- The concept of employer matching

- The tax benefits of retirement plans

Let’s set the playing field with the first couple concepts. To raise morale please remember that if you get through this article you understand more than the average person regarding retirement and financial planning for your future. The important thing to remember here is that you will need to save for retirement, that is because as of 2019, at least in the United States, the average monthly social security payment from the federal government only amounts to $1,422, which is a small amount for all of your living expenses.

The first two items we want to discuss are “Defined-Benefit Pension Plan” versus “Defined-Contribution Retirement Plan.” Or simply “Defined-Benefit,” versus “Defined-Contribution.”

Two Basic Types of Retirement Plans:

Defined-Benefit (1) – A retirement plan that provides a specified payment amount in retirement. This is commonly thought of as a pension plan.

Defined-Contribution (2) – A retirement plan that allows employees to contribute and invest funds over time to save for retirement.

Here is the important concept to realize with each of these plans. In a “Defined-Benefit (1)” plan your employer will tell you exactly what you will receive each month in retirement. The employer takes the risk of saving and investing funds for you and will guarantee a specific amount of monthly payments in retirement. In a “Defined-Contribution (2)” plan you decide how much you want to contribute from your paycheck each month and invest that in a retirement plan. In this case you take the risk regarding what you invest your funds in. What I mean by risk is that you may invest in stocks or mutual funds that you employer has available but those investments over time could return something like 5% or 10%. In addition, if you retire when the stock market or bond market is up or down that impacts how much money you have access to. Let’s look at some examples below. Once we get these two concepts, we can look further into the tax implications nd understand why it makes sense to contribute to these plans.

The Concept of Employer Matching:

This concept will only apply to “Defined-Contribution (2)” plans. With “Defined-Benefit (1)” plans the employer is in the position to calculate what they consider contributions to your future pension plan payouts.

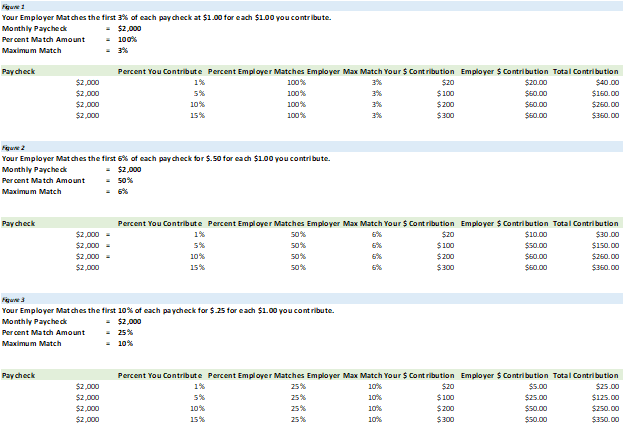

If you have income to contribute to your “Defined-Contribution (2)” retirement plan your first goal is to meet your employer match. For each dollar you contribute to yourplan your employer will also contribute an amount that maxes it out at a percentage of your income. They may, for example match the first 6% of your paycheck every pay period whether it be twice a week or once a month. For instance, you may contribute your first 6% of each paycheck before taxes to your retirement fund and your employer may then contribute an additional 6% to your retirement fund. The 6% you contribute not only is pre-tax income that you will not pay taxes on, but you also get that 6% matched by your employer. What changes with different employers here is both your maximum employer match as well as what your employer contributes for each dollar you contribute. For example, an employer may match dollar for dollar up to 6% or they may match $.50 for each dollar you contribute up to say 8%. In Figures 1–3 we look at a person who earns $2,000 each paycheck. We then calculate the amount the employee contributes to their plan and use that to determine what the total retirement contribution is each pay period.

We need to notice that there is a maximum cutoff for how much the employer will contribute noted in column “Employer Max Match.” This is the maximum amount the employer will contribute for each paycheck.

NOTE: Do to sizing you may need to zoom in for the examples below.

The Tax Benefits of Retirement Plans:

Now that we have reviewed the contribution methods for each plan it is time to discuss the other advantage of contributing to a “Defined-Benefit (2)” retirement plan. We have already shown in Figures 1-3 above that contributing to a retirement plan with an employer match has the benefit of getting what people often call “free money.” For a portion of money, you contribute, your employer will match that amount at a certain rate. However, the other benefit of the retirement plan is that you can save taxes on what you contribute and later withdraw. There are two types of defined-contribution retirement plans that have different tax implications.

Traditional Defined-Contribution Plan: In a Traditional “Defined-Contribution (2)” plan the money that you contribute is removed from your paycheck before taxes are paid. This only applies to the amount you contribute and is distinctly separate from the employer match. The benefit of this is that your money grows over time based on what you contribute without the taxes being paid until you remove money from your plan in retirement. Thus, while contributions lower the amount of money you take home each pay period, you do not pay any taxes on that money when you contribute to your plan.

Roth Defined-Contribution Plan: In a Roth “Defined-Contribution (2)” plan you will will pay taxes on the amount of money when you contribute to your plan each pay period, however, when you wtihdraw that money in retirement you do not pay taxes. In short, a Traditional plan saves taxes going in and a Roth plan saves taxes going out.

To keep it simple with a Traditional “Defined-Contribution (2)” plan you will not pay taxes when you add money to the plan, however, you will pay taxes based on your income bracket when you remove money from the plan. With a Roth “Defined-Contribution (2)” plan you do pay taxes based on the money you contribute but when you withdraw the money you do not pay taxes on the retirement funds you remove.

The main point here is if you believe they will be in a higher tax bracket when making contributions versus when they retire you should be in a Traditional Plan while people that believe they will be in a higher tax bracket when removing funds from the plan should be in a Roth Traditional Plan.

NOTE: Here is where it gets sticky. Most people will get you this far and then not give you an idea of what plan you should pick. Finance in general gets sticky because we cannot predict the future but we need to make a decision. All you can do here is really take the following into consideration:

How long do I plan to work in this lifetime? Most likely if you are working until the age of 65 (IRS guidelines for withdrawing from your retirement plan without a 10% early penalty), you will most likely have a higher income at retirement. If you withdraw money prior to 59.5 you currently will pay a 10% penalty when you withdraw as opposed to no penalty after 59.5. If you think you will work part time in retirement or not work at all you will probably be in a lower tax bracket at retirement and should a Traditional Plan. Doing this means you will pay taxes when you withdraw the money and those taxes will be lower. On the contrary if you have lots of other income you plan to receive in retirement and you think you will be in a higher tax bracket or continue to work full time, you would want to choose a Roth Retirement Plan. Again, all you can do is make an informed prediction here and there is a good chance thing can change. Do not let this stop you contributing now, the difference is minor and you get some tax savings with either type of “Defined-Contribution (2)” plan.

NOTE: It is important to realize that you may begin withdrawing money from your retirement plan at the age of 59.5 per current IRS rules and will not pay any additional taxes above and beyond your plan choice when withdrawing money. In addition, you only need to start taking required withdraws from your retirement account at the age of 70.5. So, if you can wait until 59.5 you should because you will not face a large tax penalty. In addition, if you can wait until 70.5 to withdraw the money you will save some taxes as the money continues to grow. An important concept to add is that at 70.5 there are minimum distributions that you must take from your retirement account regardless of if you would like to or not. The amounts are outside the scope of this article and will be discussed in the future.

Review:

Once again we have been able to tackle some tough concepts here.

- We now understand the difference between a “Defined-Benefit (1)” which is also known as a pension plan which pays you a set amount in retirement versus a “Defined-Contribution (2)” which pays you an amount based on the value of your assets in the plan and what you withdraw, there is more risk to this plan

- We reviewed the concept of employer matching which is money that your employer contributes to your retirement plan based on what you contribute.

- We reviewed the tax implications of a Traditional Retirement versus a Roth Retirement Plan which determines whether you are taxes on your contributions when you make them or taxes on your withdrawals when you use them in retirement.

- We learned the age requirements for early withdraw before 59.5 which charges you 10% in taxes as well as the required minimum withdraw which begins at 70.5.

Hey there 🙂

Your wordpress site is very sleek – hope you don’t mind me asking what theme you’re using?

(and don’t mind if I steal it? :P)

I just launched my site –also built in wordpress like yours– but

the theme slows (!) the site down quite a bit.

In case you have a minute, you can find it by searching for “royal cbd” on Google (would appreciate

any feedback) – it’s still in the works.

Keep up the good work– and hope you all take care of yourself during the coronavirus scare!

Hi there and sorry for the delay. I hope this doesn’t come too late. I have not been checking comments here lately. The theme is “Velux.” I will take a look at your site, I don’t get too many comments so this is cool!