There is a very common misconception regarding how income taxes are calculated within the United State. In this short article we will try to explain how your total income tax is calculated. To do this you will need to use the table below which shows tax rates for different levels of income. We will also define a Progressive Income Tax is as well as a Marginal Tax Rate. With these two concepts and our table in Figure 1 we will be able to understand how our income tax is calculated. Below are our definitions.

Progressive Income Tax – A tax that imposes a lower rate on low-income earners compared with those of a higher income. This means that the tax rate is based on a person’s ability to pay based on what they earn. High-income earners will pay a higher tax rate on what they earn as opposed to those who earn less income and pay a lower tax rate.

Marginal Tax Rate – The tax paid on the next dollar of income. This is important because since we have a Progressive Tax Rate, we will need different tax rates for different levels of earnings.

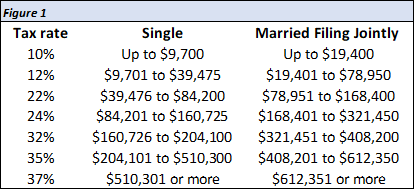

Figure 1 shows the marginal tax rates for individuals in the United States based on their level of income. The table is for Federal not state or local taxes as of 2019 for taxes that are due on April 15th, 2020. In addition, there are two columns based on whether you file as a single person or file jointly with your spouse in one combined tax return.

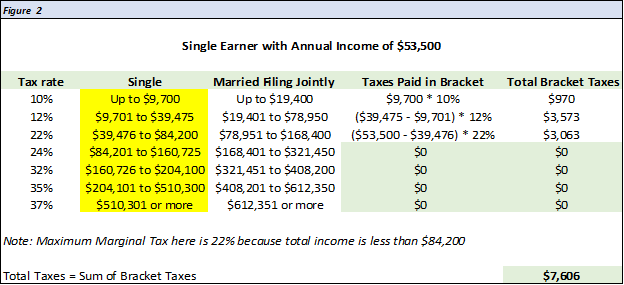

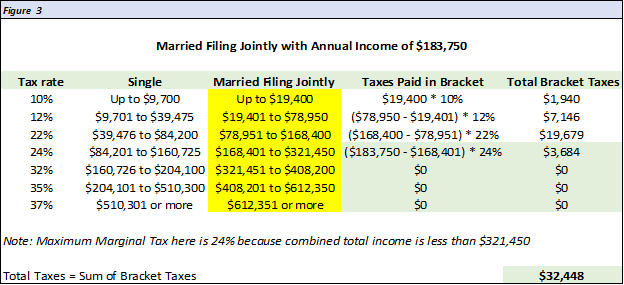

To calculate your Federal Income Tax, we now need to combine the two new terms we just learned above. We will then review an example for a Single person filing their tax returns as well as a Married Filing Jointly couple. For this exercise we will use all the necessary income tax brackets in the table above based on your total income earned as well as all the tax rates up to the max amount of earned income. This means that we do not just use one tax rate based on our total income, we need to calculate the taxed owed for each Income Bracket and sum them all to get a total amount for our income tax. Figures 2-3 perform this calculation.

CONCEPTS

In this short article we learned:

- A progressive tax rate charges higher taxes for people earning higher amounts of income

- A marginal tax rate is the highest tax rate you are charged based on your income bracket

- To calculate your total taxes, different rates are used which are assessed based on different portions of your earned income up to your maximum bracket

Great content! Super high-quality! Keep it up! 🙂

Thanks you! It takes a decent amount of time for me to write these articles and the comments keep me going.