The topic of net worth frequently appears in discussion. It is used as a measurement of what someone is worth at a point in time. Similar to how companies use a balance sheet as one of the three main financial statements, your net worth can be calculated using your personal balance sheet. Don’t worry, we will only approach a very basic accounting subject here and we will do it on a personal level. Below we will get you familiar with three terms and then form the basis of how we are going to calculate net worth. Let’s first discuss three terms Assets, Liabilities and Equity. There are many different terms for these, but they are all basically the same so will keep it simple and give some examples. We are not going to be valuing your future pension plan or your retirement assets at this point, they are large assets but outside the scope of this article and involve an additional concept called “Present Value.”

Asset – An item of value that you own outright or through some form of a loan or debt

Liability – An item that you owe money for, such as a mortgage on a home or a car loan

Equity – The amount left over after liabilities are subtracted from assets (your investment)

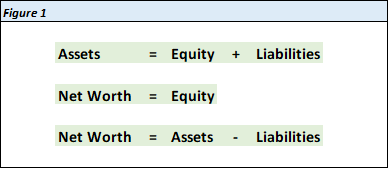

Now we can look at the basic equation to get us to net worth. We will then move through some examples of each of the three terms in Figure 1 below.

Using the figure above we have now figured out the simple equation to calculate our net worth. Keep in mind that each of these items above can be made up of many different, more specific items. Here we can look at a list of items and how they fit into each category. We can then sum up all these that we own or owe money on to get a view of how much we are worth in total. Before that look at the example below:

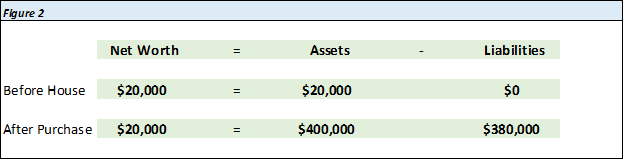

You purchase a home for $400,000. You initially invest $20,000 as a down payment and borrow $380,000 for the remaining portion in the form of a mortgage that you will pay overtime. In the two steps illustrated in Figure 2 below, we can see what our net worth looks like before (step 1), and after (step 2), we purchase the house. For simplicity we will assume that just before we bought the house, we didn’t own anything other than the $20,000 in cash that we then used for the down payment. We had no other house, no car, no stocks, no furniture at all. Remember, in these exercises to make things clear we always start simple. We also assume we have no debt.

What is going on here? What can we observe:

- When all we had to our name was $20,000 and no debt, we had a net worth of $20,000 and had assets of $20,000 and liabilities (debt), of $0.

- After we purchased a house, we still only had a net worth of $20,000.

- After we purchased the house, we now had debt equal to what we borrowed of $380,000.

- After we purchased the house, we had an asset worth $400,000 but don’t be fooled, you only owned a portion of that asset ($20,000), your bank owned the remaining $380,000 which you took on as debt.

So, the fundamental thing we learned here is that if this equation holds true, even though we purchased a home, which is a very large asset, we took on a lot of debt to purchase the home and nothing changed regarding our net worth.

CONCEPT: Without any other changes and just moving around our assets and liabilities we cannot create or destroy net worth. In other words, just because you purchased a house mostly on debt, does not mean that you increased your net worth, most of that house was funded by borrowed money in the form of a home loan.

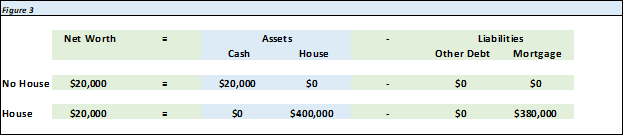

Let’s now sharpen Figure 2 a little bit more to look at what was moving around in each of the three main items we are focusing on. After this step we can begin to throw multiple different items (not just a house), into the equation and get a picture of our total net worth. Figure 3 below goes into a little more detail on what accounts are being changed between step one and two in each of our three items. Here we have shown how our assets and liabilities moved between different accounts (cash account versus accounts related to the home purchase).

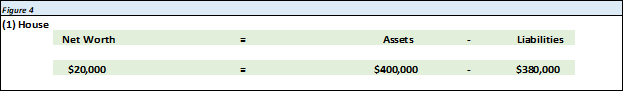

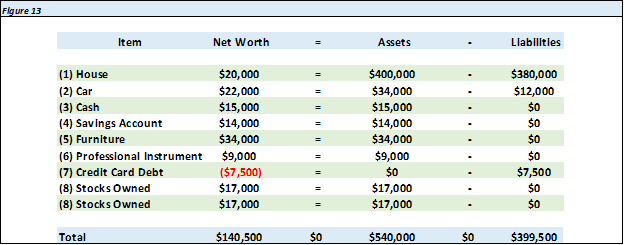

At this point you have an idea of what happens when you purchase a house and how to calculate net worth before and after. Now let’s look to Figure 4 – Figure 11 and review some other items that fit into our three categories of net worth, assets and liabilities. We then sum these all up to calculate a total net worth.

Figure 4 depicts the house that we originally purchased with the help of a large mortgage.

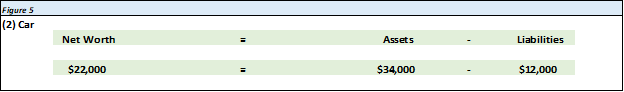

Figure 5 shows a car that we purchased with a $12,000 loan remaining.

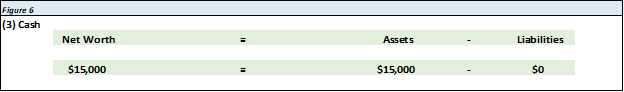

Figure 6 shows the current cash we have physically in our house and wallets as well as hopefully a bank account.

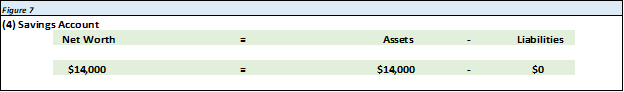

Figure 7 depicts how much money we have stored in a savings account.

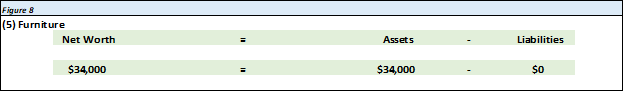

Figure 8 is the total amount of money that we have spent on furniture without any loans.

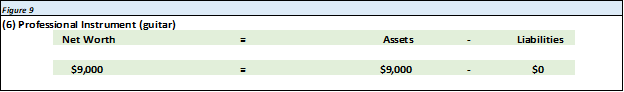

Figure 9 shows us an instrument, probably a rather nice one, that we purchased with no debt.

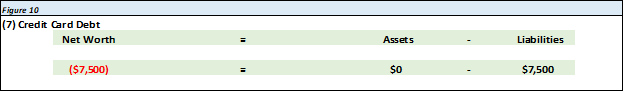

Figure 10 shows us how much credit card debt we have. Keep in mind that this debt is the only item that does not appear as an asset. Perhaps some of this debt went into purchasing our instrument or food. In this case however the debt on our credit is based up of many separate purchases maybe for gas and food and other assets that we have consumed so we can lump it into one item for all our credit card debt. If we do this for this exercise, we can leave the small portion of credit card debt for other items out of any individual piece of furniture, appliance, instrument or perhaps a computer. It will all be captured in our total credit card debt below. This will keep us from going crazy on small amounts of debt that we have spread over a multitude of different small items.

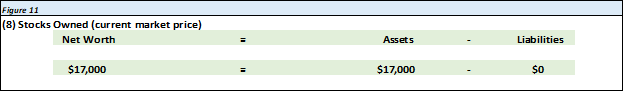

Figure 11 shows us that we currently have $17,000 invested in stocks, the $17,000 is quoted as at what we call “current market price,” which is the current stock price using a resource such as The Wallstreet Journal, Yahoo Finance or TD Ameritrade.

NOTE: We are making a large assumption for all of these for simplification which is described below and that is that the purchase price for all our items is equal to the current price on our financial statements.

What do we mean when we say the purchase price of the items is equal to the current price on our financial statements above? This implies that there has been no wear and tear or damage to any items. Thus, there is a no time-based depreciation as well. For example, we all hear that a car loses some percentage of its value the moment you drive it off the lot. In our example the car does not lose this value. In the future we can discuss how to update our balance sheet to consider damages or normal loss in value to our assets over time. For now, we just use the purchase price and our current debt to determine each component of our net worth. We need to keep in mind though that in the future we will need to consider the wear and tear on that car that lowers its resale value which is our asset value.

Now we can complete our last step in calculating our current net worth which is shown as a sum of all the previous items in Figure 12 below.

There we have it. We have now completed a pretty rigorous calculation of our current net worth based on everything we own from Figures 4 – Figure 11 and how much debt we owe on the items we own. In theory if someone were to buy everything we own, including our cash, this would be what it is worth. Taking into account the simplifications listed earlier in this article regarding purchase price and depreciation over time we have an idea of the wealth we have accumulated so far in our life. This has captured what we call a “point in time” value or “stock” value of our current net worth. This article should have helped you get a good idea of what you have created in wealth over your lifetime, great job for getting through some new accounting topics!